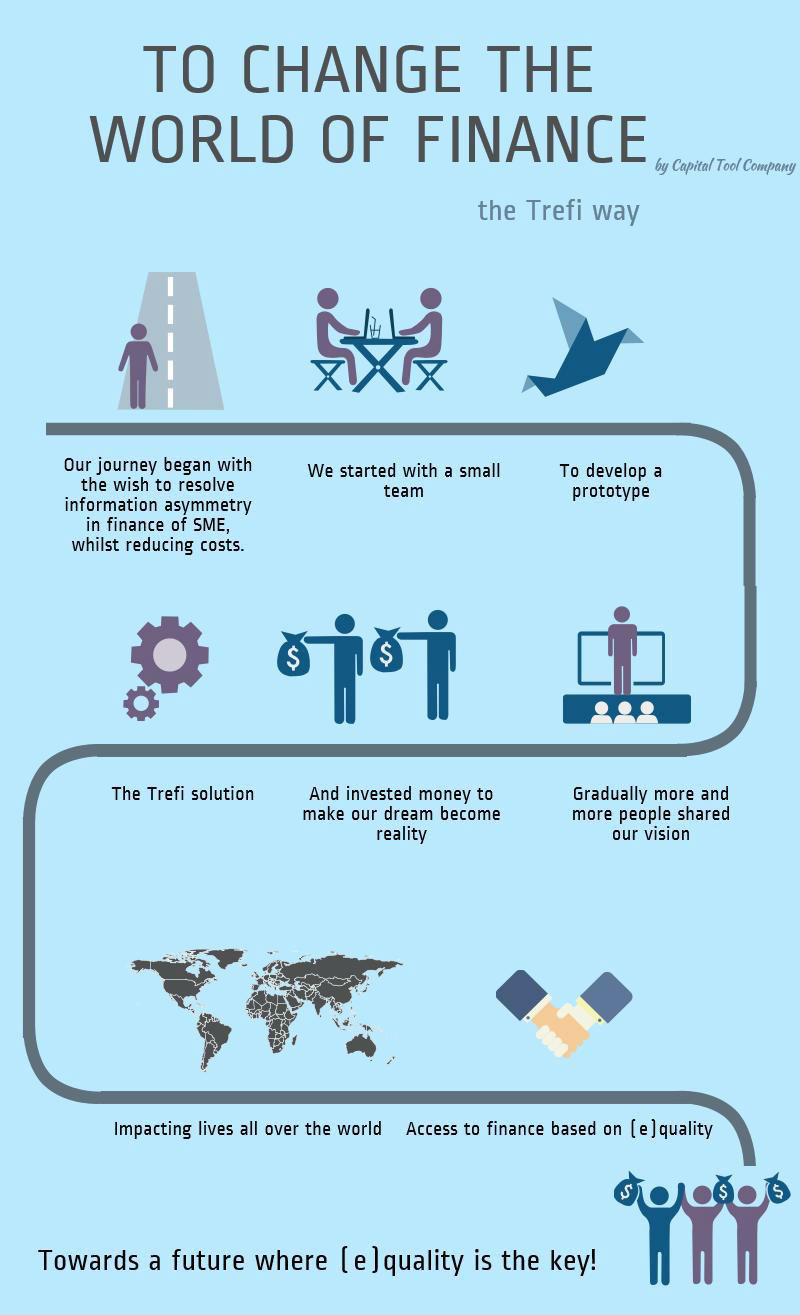

OUR STORY

BORN OUT OF COOPERATION, IT’S THE PARTNERS THAT MAKE TREFI WORK

The Trade Receivable Standards Board (TRSB) provides a standard for financing receivables. Its mission is to:

- Enable standards for customer credit and receivable finance that ease transactions

- Ensure standards provide a fair environment to ease receivable finance for companies and financiers of any size

- Stimulate best practices in receivable finance to optimize supply-chain financing

- Stimulate the ease, security and efficiency of trade

TRSB enables the standardization of receivable finance transactions to ease their transactions and liquefy trade.

Capital Tool Company is the leading provider of receivable risk-based valuation tools and develops cutting edge financial solution technology to value credit and liquidity risks of receivables. CTC has developed the platform underlying Trefi and calibrates the Trefi risk models.

At Trefi, you’ll get to work in the high performance environment of a company that’s leading change in the financial world.

We value openness, collaboration, creativity and teamwork.

This is a unique opportunity to use and develop your skills where you’ll be able to make a difference for Trefi’s organization, its customers and its products.

If you dream of:

- Working in a sophisticated, dynamic and entrepreneurial environment

- Being part of a team that drives the progress of our customers, products and organization

- Operating in small teams with a high level of responsibility from day one

- Working in a multinational environment with other companies and financiers

- Using the latest trends and innovations in finance, IT, and risk technology

You’re just one click away from meeting us!

Receivable management partner to help customers collect their receivables. They include: Atradius, Intrum Justitia, and Credit Alliance.

Integration partners help customers connect Trefi to their systems. Partners include: Exact, Invoice Sharing, d-Basics.

Data and Risk partners work with Trefi to provide the best risk information on the market.

Credit Insurance partners provide access to insurance products for financing received through the Trefi platform. Partners include: Euler Hermes.